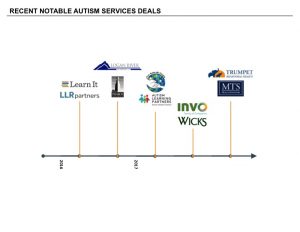

In the past 18 months, at least 10 providers of applied behavior analysis (ABA) autism intervention services have been acquired or received investments from institutional investors. Why is this sector so attractive and why does it garner the attention of private equity investors?

Growing Incidence of Autism

The CDC estimates autism’s prevalence today as one in 68 children in the U.S.—an increase from one in 88 as of 2013. With a growing population of children in need, the industry shows high patient demand tailwinds. Further, ABA services are accepted widely as the most effective in autism intervention services, an important consideration as the payor landscape grows more demanding and increases its level of sophistication when selecting service providers.

Fragmented Market With Opportunities to Consolidate

The landscape of ABA service providers is populated largely by a fragmented universe of smaller providers, ranging from school districts employing their own behavior interventionists to non-profit agencies to private behavioral health service providers. It is estimated that fewer than five “pure play” companies are operating on a national scale. Investors aggressively seek well-established platforms with the back office systems, clinical programs and management teams that can support growth strategies.

Favorable Tailwinds in Reimbursement and Funding Environment

After several years of strong advocacy, over 44 states now have legislation requiring insurers cover autism intervention services, up from 32 states in 2013. Further, the Accountable Care Act (remember—it is still the law of the land) no longer allows insurers to deny, limit, exclude or charge more for coverage to anyone based on a pre-existing condition, including autism and related conditions. Finally, early diagnosis can improve the quality of care and dramatically mitigate the life care costs, estimated to be near $3.2 million for one individual, a highly important consideration in today’s value-based healthcare movement.

What Drives a Premium Multiple?

In addition to the market factors referenced above, companies that possess the following attributes can command premium valuation multiples as they are more likely to serve as consolidators of additional autism services providers:

- Premium quality and integrity of ABA services, along with systemized intervention protocols;

- Back-office infrastructure to manage patient volumes and increasingly complex insurance payors;

- Multi-state or multi-regional service footprint with diverse revenue sources; and

- Sophisticated service delivery and management technology.

We expect to see more activity in the autism services space as the market matures and strives to provide these important services to a growing population in need.