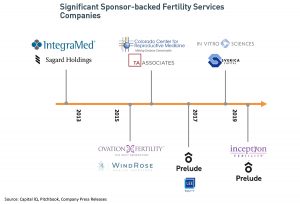

Private equity sponsors focused on healthcare seem to be searching for the next nascent physician specialty that is ripe for investment, consolidation, and growth. Based on our team’s dialogue with healthcare investors, fertility services is one specialty that seems to be attracting strong interest this year. As evidence of the activity, in late March, a significant deal was announced where Prelude Fertility (backed by Lee Equity Partners) and Inception Fertility merged to become the largest fertility services company in the U.S. What are the reasons why the fertility services space is attracting strong interest? Following are some key drivers:

Compelling Demographic Trends

More women are postponing motherhood until they are older, thereby increasing the likelihood they will need fertility services. In 1980, approximately 20% of pregnant women were over the age of 30, compared to nearly 44% in 2015, with the percentages expected to continue to rise. Such long-term trends attract investors because these demographic trends imply a market size expansion that is likely to drive organic revenue growth.

Increasing Insurance Coverage of Fertility Services

In the U.S., most consumers pay out of pocket for fertility services. However, a growing number of employers across the country are beginning to offer fertility benefits. Analysts estimate that 66% of employers expect to offer some fertility benefits in 2019 compared to 55% in 2017. Employers view these benefits as powerful tools to support organizational diversity and inclusion objectives, recruit/retain talent, and optimize employee satisfaction. While investors largely expect this industry to remain predominately cash pay, they expect these tailwinds to help propel growth via an expanding addressable population.

Growing Prevalence of Fertility Tourism

The U.S. has become a major destination for global fertility tourists because of its technological capabilities and relatively lax regulations. China has become a particularly large source of fertility tourists as a result of rising incomes, a shortage of fertility providers, strict government policies, and the end of the One Child Policy. Some investors see opportunity in this segment of the market while others ascribe greater risk given the additional reliance on foreign government policies.

Highly Fragmented Market, Primed for Consolidation

While many physician specialties are fragmented, fertility services are especially early in their consolidation cycle. Although there are over 450 fertility clinics in the United States, only 30% perform more than 500 in vitro fertilization (IVF) cycles annually and less than 15% perform more than 1,000 IVF cycles per year. Our Healthcare team’s conversations with investors canvassing the space highlight the rarity of practices with more than five physicians. Due to the varying size and throughput in these programs, many fertility clinics are outsourcing certain ancillary services to specialists, which could be more ideally offered in-house at higher volume providers. While fragmentation creates opportunity, it also creates challenges to find practices suitable to serve as platforms, since these relatively small groups also have less scalable back-office functions. Fertility practices with more than five physicians, more than 500 cycles, and a sophisticated administrative team should be highly desirable assets.

Overall, private equity sponsors want to replicate proven physician practice investing playbooks in the nascent fertility services segment. These tools generally include improving back-office functions, acquiring smaller practices, enhancing consumer marketing, and insourcing key ancillary services (egg banking, surrogacy, diagnostics, etc.). Given some of these trends, we expect to see increasing M&A activity, yet investors will continue to have a high bar to address issues like smaller practices, provider concentration, high-cost cash-pay reimbursement and growing regulations.