Software & ServicesTechnology & Media

Software & Services

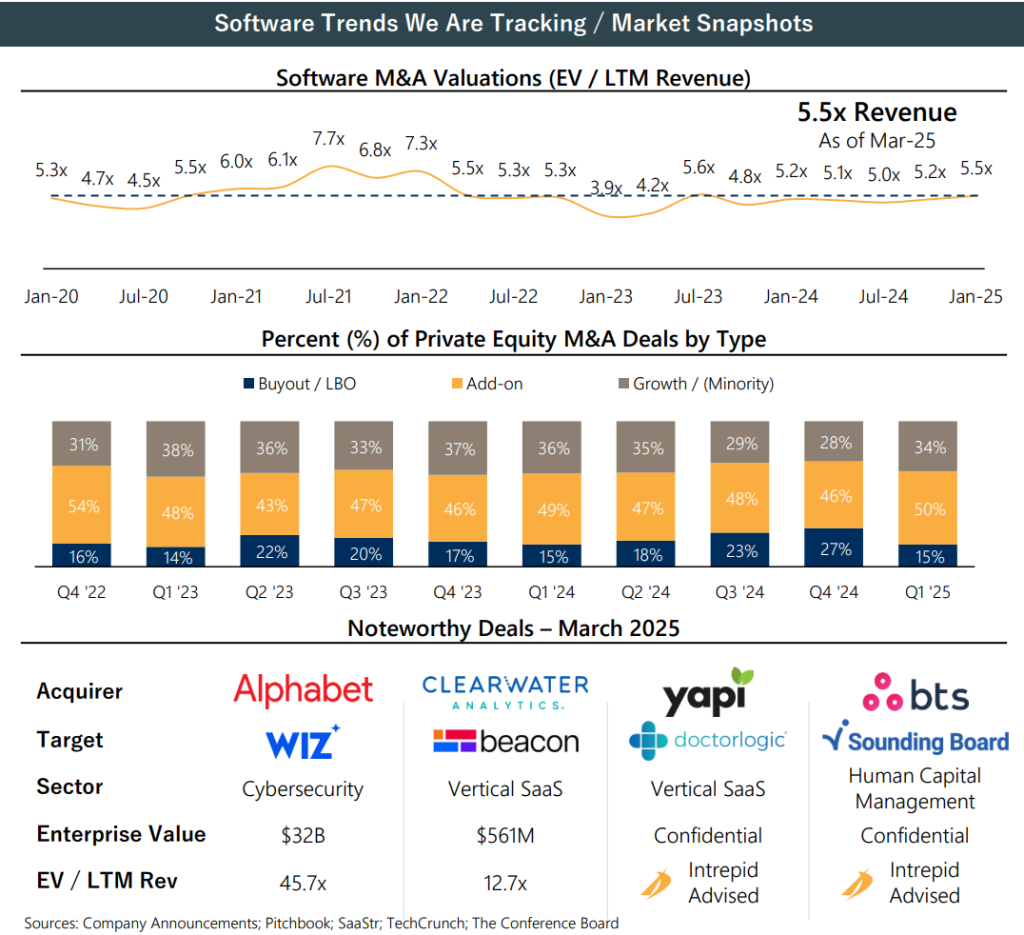

Despite strong initial anticipations for 2025 tech M&A, market volatility over the past two months from tariffs / threat of a trade war and stubborn inflation have contributed to subdued deal activity as the market awaits more stable conditions.

Despite strong initial anticipations for 2025 tech M&A, market volatility over the past two months from tariffs / threat of a trade war and stubborn inflation have contributed to subdued deal activity as the market awaits more stable conditions.- Although financial sponsors face growing hold periods for existing portfolio companies and are starved for new platform investment opportunities, 2025 tech M&A deal count has been muted so far.

- Macroeconomic stability, when it arrives, could bring to bear the pent-up demand of sponsor-backed sellers and buyers into the market, generating high levels of deal activity.

Connect with Our Team

- Christopher Park, Managing Director, Head of Software & Services, CPark@IntrepidIB.com

- Jeff Becker, Managing Director, Software & Services, JBecker@IntrepidIB.com

- Josh Moses, Managing Director, Software & Services, JMoses@IntrepidIB.com

- Ryan Makis, Director, Software & Services, RMakis@IntrepidIB.com

Sell-Side AdvisorySoftware & ServicesTechnology & Media

Intrepid Advises Sounding Board on Sale to BTS Group to Expand Global Leadership...

Sell-Side AdvisorySoftware & ServicesTechnology & Media

Intrepid Advises Yapi, a Portfolio Company of M33 Growth, on Its Merger with DoctorLogic

Sell-Side AdvisorySoftware & ServicesTechnology & Media

Intrepid Advises SCLogic on its Sale to iLobby and Subsequent Rebrand to FacilityOS

Software & ServicesTechnology & Media

M&A Market Monthly – March 2025

Sell-Side AdvisorySoftware & ServicesTechnology & Media

Intrepid Advises Collective Solution on Its Sale to GlowTouch, a UnifyCX Company

Sell-Side AdvisorySoftware & ServicesTechnology & Media

Intrepid Advises LinkUp on Its Sale to GlobalData

Sell-Side AdvisorySoftware & ServicesTechnology & Media

Intrepid Advises The Talent Enterprise on Its Sale to Mercer

Buy-Side SearchSoftware & ServicesTechnology & Media