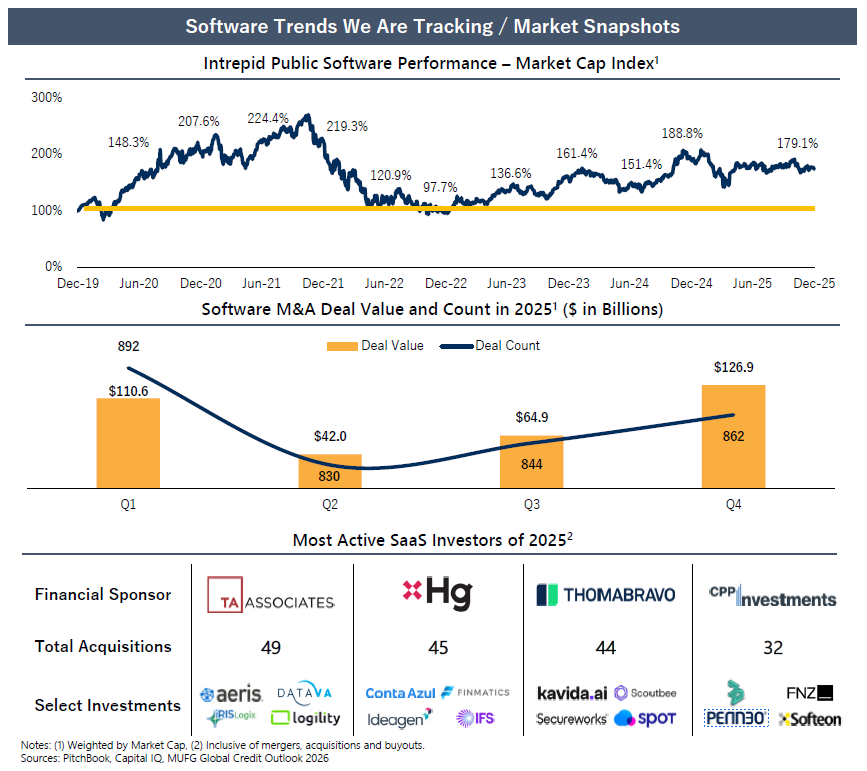

- Global M&A volume is projected to reach ~$5.0T in 2025, ranking second only to 2021. Tech leads the surge, accounting

for ~22% of 2025 global deal volume. - Financing tailwinds continue to strengthen in December. The Fed’s third consecutive rate cut to 3.50% - 3.75%, and tightening U.S. leveraged-loan spreads, are tilting deal terms toward borrowers, driving scale and participation in SaaS acquisitions.

- Software M&A delivered 74 megadeals surpassing $5 billion in 2025. With AI-related transactions accounting for more than 20% of deal volume, reflecting continued confidence in AI despite bubble concerns.

Connect with Our Team

- Christopher Park, Managing Director, Head of Software & Services, CPark@IntrepidIB.com

- Jeff Becker, Managing Director, Software & Services, JBecker@IntrepidIB.com

- Josh Moses, Managing Director, Software & Services, JMoses@IntrepidIB.com

- Terry Jiang, Managing Director, Software & Services, TeJiang@IntrepidIB.com

- Ryan Makis, Director, Software & Services, RMakis@IntrepidIB.com