The Nasdaq slid 1.5% in November, marking the first loss since March as investors reassess lofty AI valuations. Even strong results from leaders like Nvidia haven’t quelled concerns over a potential AI bubble and the sustainability of heavy capex.

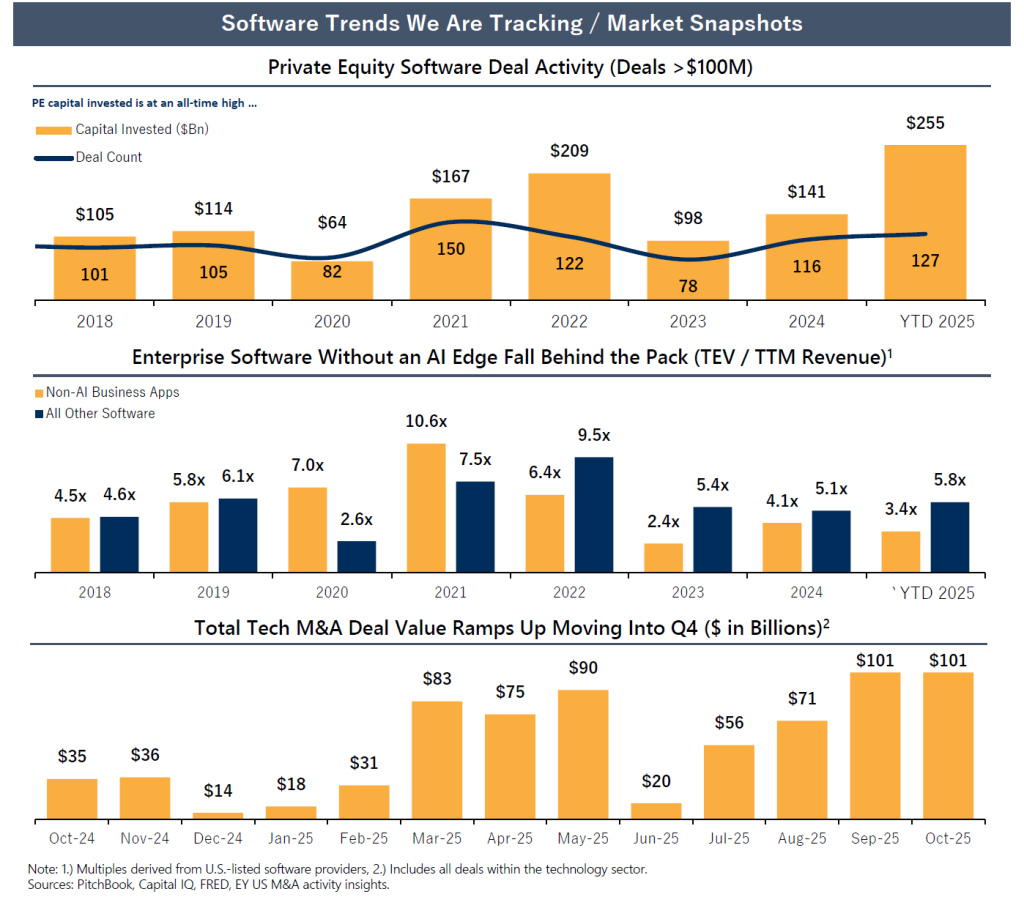

The Nasdaq slid 1.5% in November, marking the first loss since March as investors reassess lofty AI valuations. Even strong results from leaders like Nvidia haven’t quelled concerns over a potential AI bubble and the sustainability of heavy capex.- As AI transforms enterprise software, vendors without a clear AI strategy are trading at steep discounts - median transaction multiples of 3.4x revenue versus 5.8x for peers - even as M&A spending climbs to $42 billion so far this year, the highest pre-COVID annual total.

- Despite a 43-day government shutdown clouding the outlook for December’s Fed meeting, the October rate cut to a 3.75%–4% range is easing financing conditions and fueling cautious optimism for tech acquisitions and premium valuations.

Connect with Our Team

- Christopher Park, Managing Director, Head of Software & Services, CPark@IntrepidIB.com

- Jeff Becker, Managing Director, Software & Services, JBecker@IntrepidIB.com

- Josh Moses, Managing Director, Software & Services, JMoses@IntrepidIB.com

- Terry Jiang, Managing Director, Software & Services, TeJiang@IntrepidIB.com

- Ryan Makis, Director, Software & Services, RMakis@IntrepidIB.com