Beauty & Personal Care: Raising Capital and Pursuing M&A in Uncertain Times

It’s Late 2019 and Perhaps the Best Time to Be a Beauty & Personal Care Entrepreneur

There’s been an influx of investment dollars and M&A activity in the Beauty sector over the past five years. Entrepreneurs with strong brands are successfully seeking investments and exits. Venture capital, private equity groups, and strategics are all participating. You are the founder of an authentic, fast-growing beauty or personal care brand that is poised for a great year in 2020. It’s going to be the year that you get that investment from one of the top growth equity groups and excel, you may even explore an exit.

To read the full article, click here.

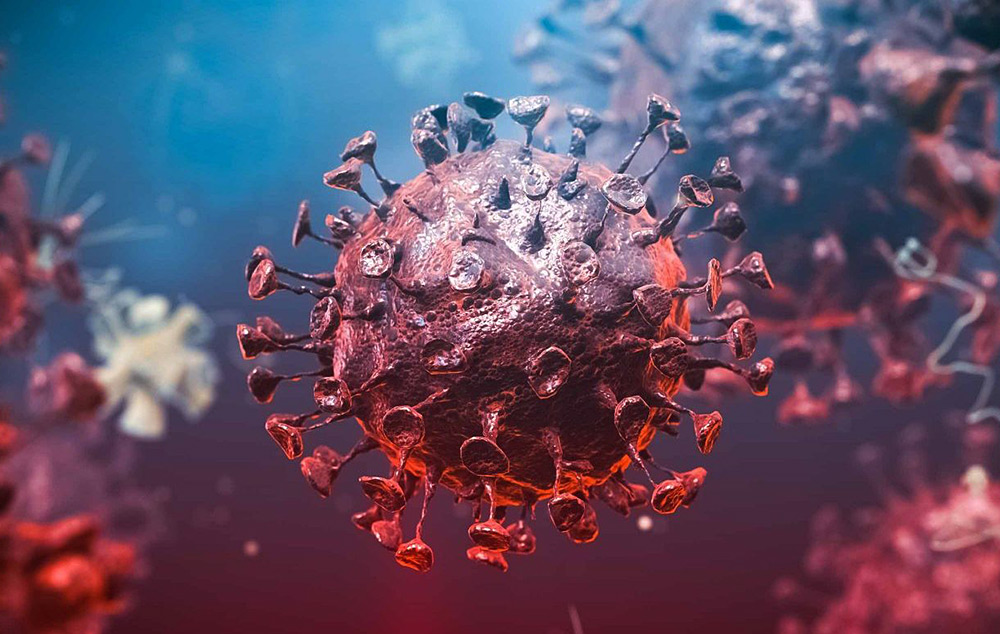

Then COVID19 Hits…

The retailers in which you were launching are closing their doors, investors and equity groups have become more discerning, and the raise and M&A landscape are murky and unclear. The future is hard to predict. Are the markets still active? What should you do?

Mike Garcia, Managing Director at Intrepid, sits down with Jessica Bates, Director at Dwight Funding to bring some clarity to founders in these times of uncertainty.

Strong Start and Rough Ending to Q1’20 – Where Do We Go From Here?

Turning Point: Don’t Count Out the Physician Practice Management Sector Just Yet

Uncertain Environment Provides Unique Growth Opportunity for Direct-to-Consumer Brands

COVID-19 Highlights The Importance of Diagnostics

What We Are Seeing in the M&A and Capital Markets

Pandemic Pandemonium and the Return of M&A

The Impact of COVID-19 on the Technology Middle Market