Media & EntertainmentTechnology & Media

Digital Media Displays Robust M&A Activity in Q2’17

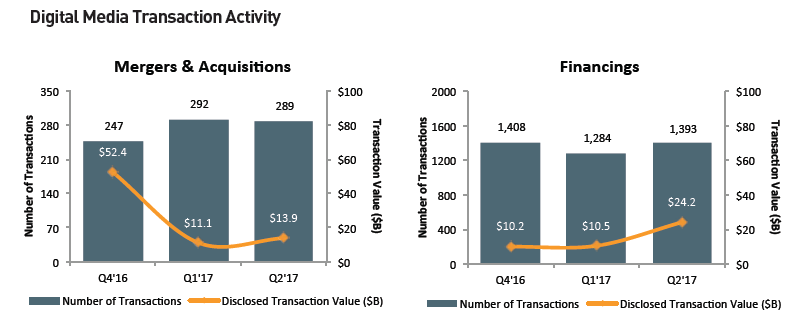

M&A and financings exhibited robust activity in Q2’17, with nearly 290 M&A transactions and more than 1,390 disclosed global financings. Key industry trends driving investments and acquisitions include:

- Increased activity in both early and late stage venture capital funding rounds;

- Retailers pursuing eCommerce acquisition targets to develop omnichannel capabilities;

- Telecom companies looking to augment core offering by acquiring data-rich targets to improve consumer advertising capabilities; and

- Growth in number of large transactions, with acquisitions over $50 million increasing by more than 55% from Q1 to Q2 and financings over $50 million increasing by more than 50% over the same period.

Beauty, Personal Care & WellnessConsumer Products & Services

Sector Deals of the Week—Unilever Enters Prestige Color Cosmetics with Acquisition...

Beauty, Personal Care & WellnessConsumer Products & Services

Sector Deals of the Week—Another Private Equity Beauty Care Platform Is in the...

Beauty, Personal Care & WellnessConsumer Products & Services

Sector Deals of the Week—L’Oréal to Divest The Body Shop to Natura Cosméticos

Beauty, Personal Care & WellnessConsumer Products & Services

Sector Deals of the Week—PDC Brands Finds New Private Partner in CVC Capital Partners...

Beauty, Personal Care & WellnessConsumer Products & Services

Sector Deals of the Week—Another Big Private Equity Group Enters Beauty Care Arena...

Commercial & Consumer TechnologyTechnology & Media

M&A Soundcheck—Q1’17 Reflects Continued Strong Activity Across All Sectors,...

Beauty, Personal Care & WellnessConsumer Products & Services

Sector Deals of the Week: Unilever Ventures Ramps Up Beauty Care Investment Pace...

Consumer Products & ServicesLifestyle Brands