**Boo!** This time of year, we might not know what’s lurking in the shadows…but one way to scare off a creeping debt maturity wall is with some mezz! In a higher-for-longer interest rate environment, addressing both leverage and fixed charge ratios is paramount to securing a healthy capital structure. If there’s something strange on your balance sheet, who you gonna call…?

- Mezzanine lenders can provide flexible financing packages, such as the ability to toggle PIK vs cash interest, no amortization, and looser financial covenants than senior debt, thus helping borrowers to minimize cash flow impact of incremental leverage

- Such structures typically are highly negotiated, with lenders seeking to develop deep relationships with borrowers. Often, lenders attempt to align interests through participation in equity and strategic advice at the board level

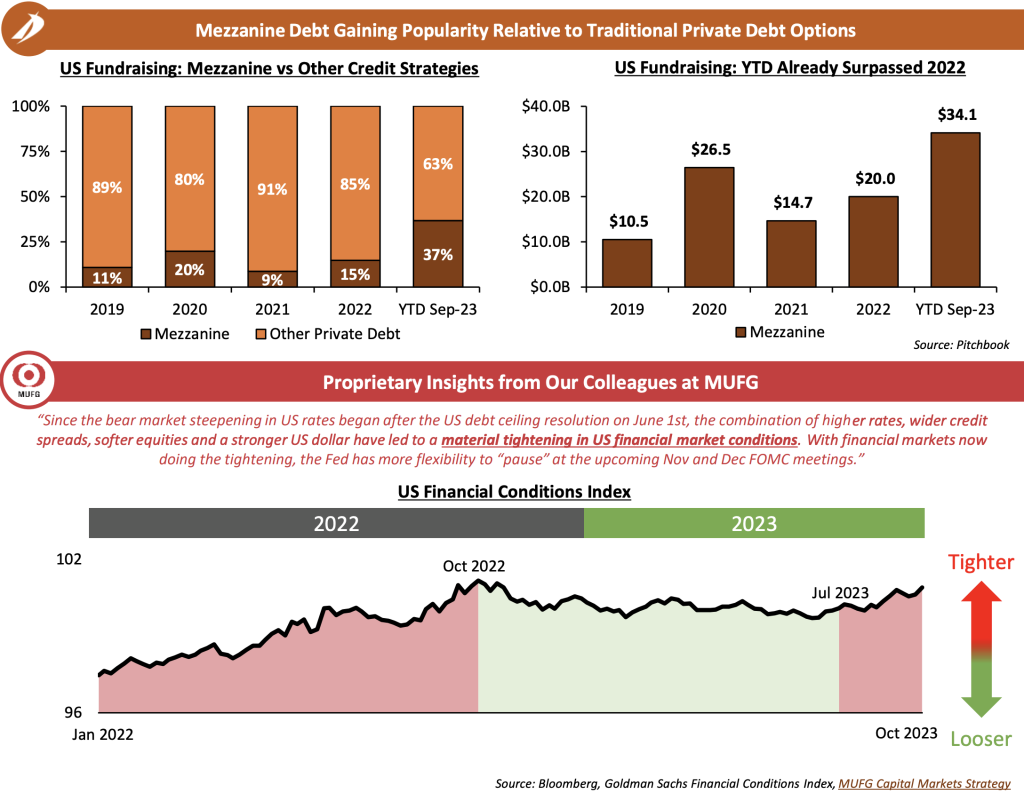

- As the cost of floating-rate instruments has spiked over the past 12-18 months, the fixed-rate structure of mezzanine debt has become increasingly competitive – leading to a material increase in fundraising activity to keep up with borrower demand

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com