Batter up! This season, MLB sluggers have embraced a redesigned bat known as a "Torpedo Bat" – which reallocates the bat's mass towards the “sweet spot” – to offset slumps in the batter’s box. In similar fashion, middle-market companies are employing innovative strategies to navigate turbulence and find their own sweet spot deal structures:

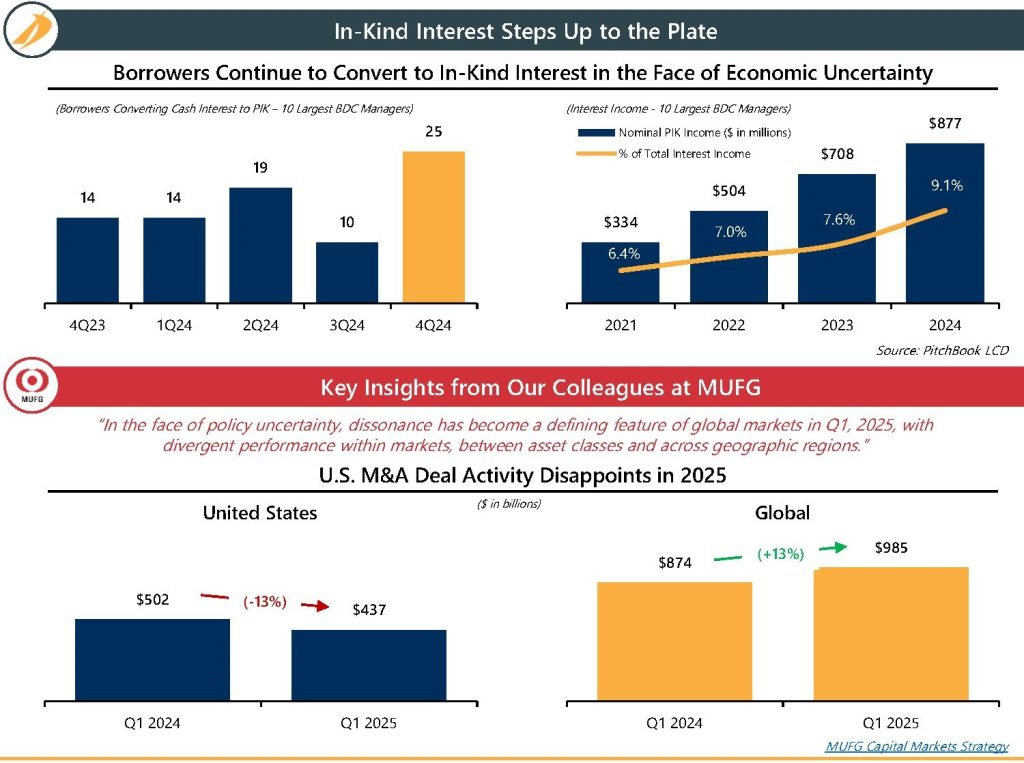

- Private credit borrowers are frequently requesting PIK (payment-in-kind) toggles for incremental cash flow flexibility, both for new and existing loans. Keep in mind, this flexibility comes at a cost – in-kind interest typically accrues at a higher rate than cash pay - but it’s better than striking out.

- In a tie game in the bottom of the 9th (stressful market), a torpedo bat (PIK interest) can make all the difference. Each bat (security) can be tailored specifically for the batter (borrower), with slight variations in shape (loan structure) to complement the batter’s unique swing mechanics (strategic goals).

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com