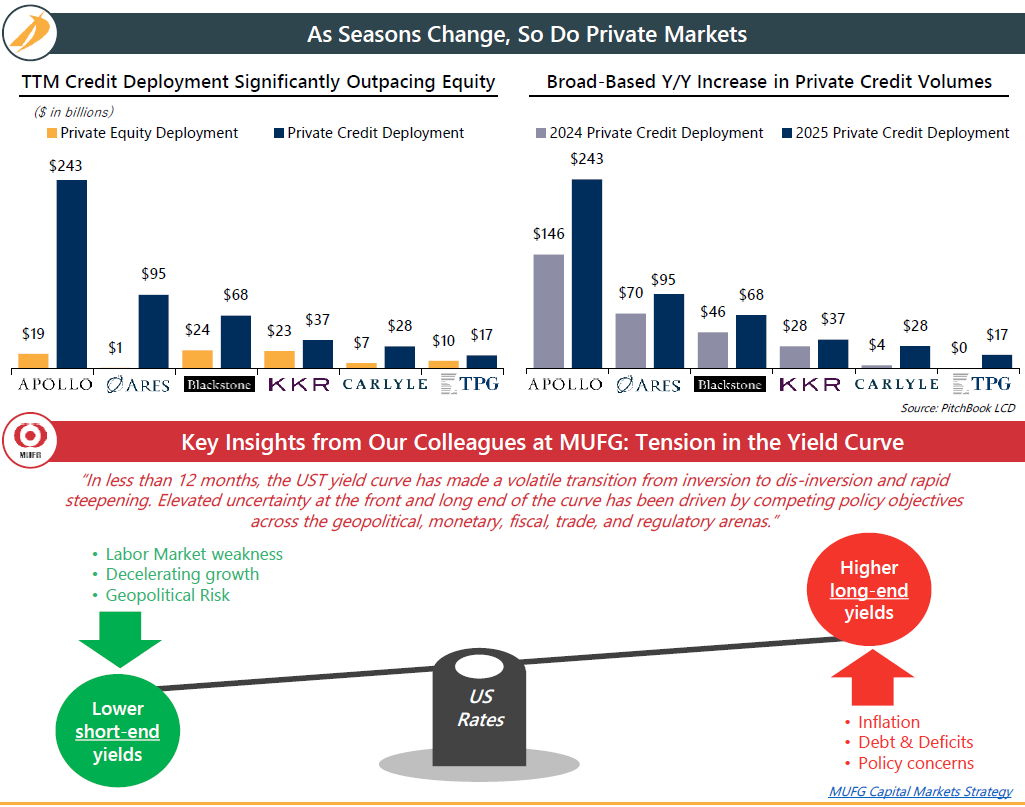

To every market, turn, turn, turn… Just as the seasons shift, so does the capital landscape. A snapshot of the large-cap asset manager ecosystem shows a rapidly diversifying color scheme of investment allocations. Deployments into private credit continue to outpace traditional private equity, demonstrating a structural shift in how asset managers see the broader opportunity set in the U.S. private markets.

- Autumn Winds Push Allocations Toward Private Credit – With interest rates higher for longer, and amid a slowdown in M&A activity, large-cap asset managers have dramatically shifted toward credit strategies.

- Abundance of Dry Powder – As we approach Q4, the private market is flush with capital and eager to get deals done ahead of the New Year. This is good news for borrowers – both in terms of cost and quantum of financing.

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com