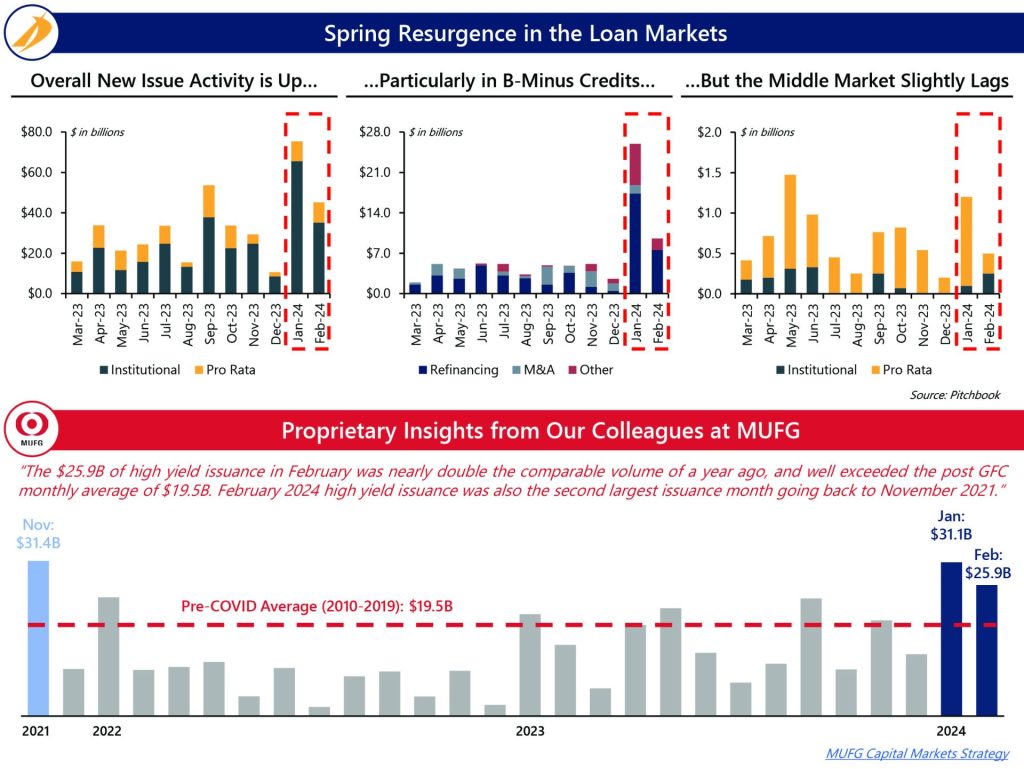

Spring has sprung! Tonight marks the spring equinox - the start of nature’s rejuvenation. Debt markets, too, are undergoing their own form of revival. In anticipation of loosening credit conditions, the lending ecosystem is buzzing with activity. That said, not all segments are opening at the same pace.

- In aggregate, new issue leveraged loan activity is blossoming, as a fresh wave of refinancing and M&A opportunities have emerged in the new year. The same is true of the high yield bond market.

- Banks are seizing the seasonal shift, particularly at the larger end of the market. Surprisingly, lower rated issuers are also seeing a flurry of activity as investors seem confident that we’ll see a soft landing.

- Middle market leverage loan issuance is up, but less dramatically. Regional banks continue to feel pressure, and have less capacity to compete with direct lenders than those at the top end of the market.

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com