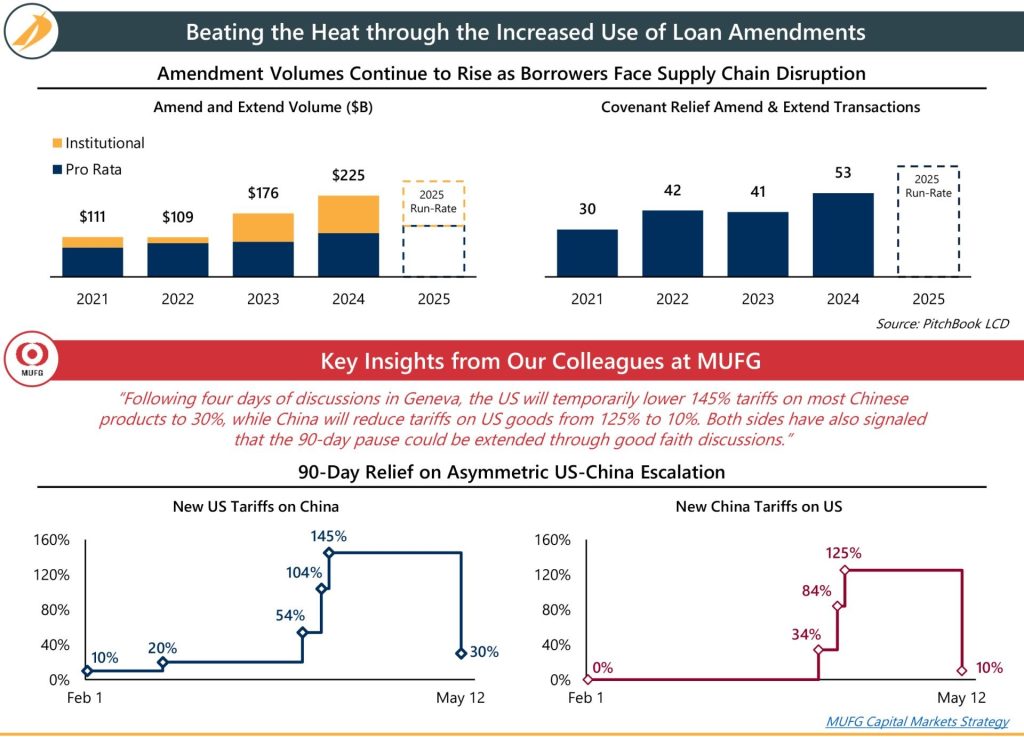

With Memorial Day weekend approaching, beachgoers are not the only ones seeking shelter from the sun. Notwithstanding a seemingly de-escalating trade war, corporate borrowers continue to feel the impact of tariff-related cost pressures, diminishing cash flows, and ever-thinning covenant compliance margins. Thus far, lenders seem willing to help, as structural accommodations are increasingly common in a market looking to beat the heat:

- Amend and Extend – mutual agreement to extend a loan’s maturity in exchange for more borrower-friendly terms (often interest rates), allowing borrowers to kick the bucket down the sand.

- Covenant Relief – suspension of certain covenant testing for near-term periods, providing borrowers with much needed shade to avoid heat stroke and an event of default.

- Temporary Carve-Out – temporary definitional adjustments to EBITDA for “one-time” incremental costs – a quick dip in the ocean to provide relief from tariff-induced margin compression.

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com