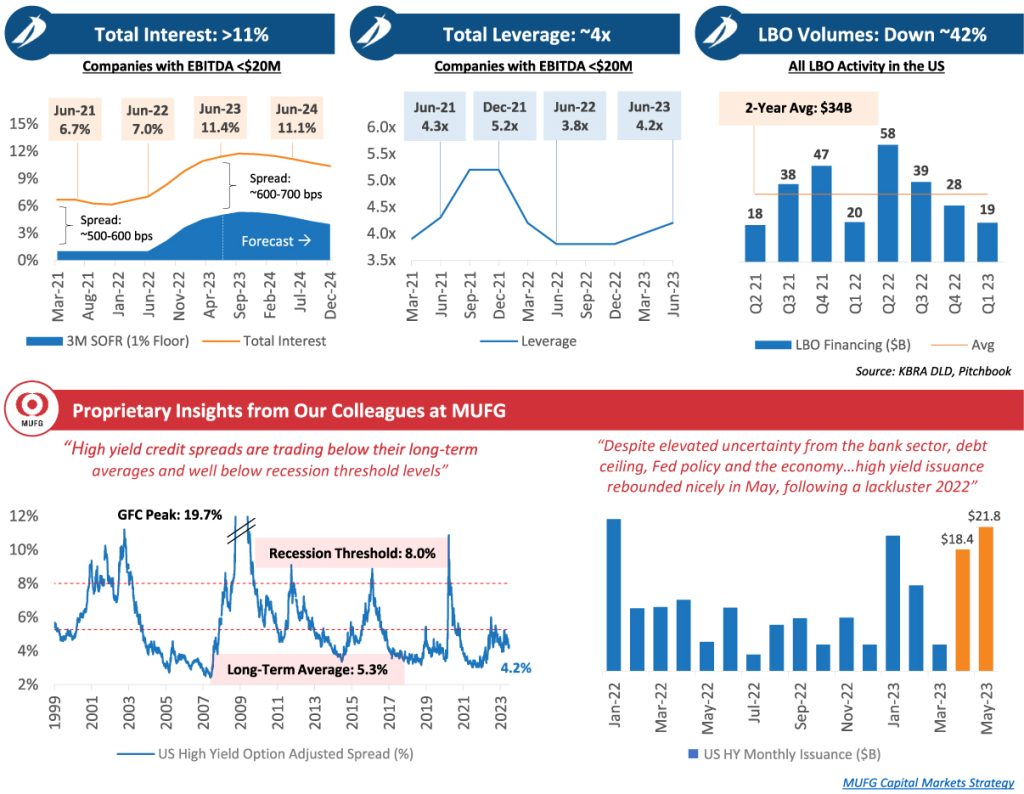

Red, White, and Expensive – higher interest rates and lower leverage continued to keep deal volume down in H1 2023. With SOFR expected to stay above 5% for months to come, fireworks may be muted this July 4th but we’re seeing some sparks on the horizon.

- Direct lenders are hyper-selective and increasingly conservative, offering lower leverage (down ~20% from peak 2021 levels) and higher spreads (100-150 basis points wider vs. 2021) while maintaining OIDs of at least 2% (but often as high as 3%)

- Investors are rebalancing portfolios toward recession-resistant sectors while continuing to shy away from consumer discretionary deals

- Diligence processes continue to elongate, with more third-party work than ever and closer attention to covenant packages

- Public market sentiment shows hopes for a soft landing for the US economy, with new issuance volumes recently rebounding

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com