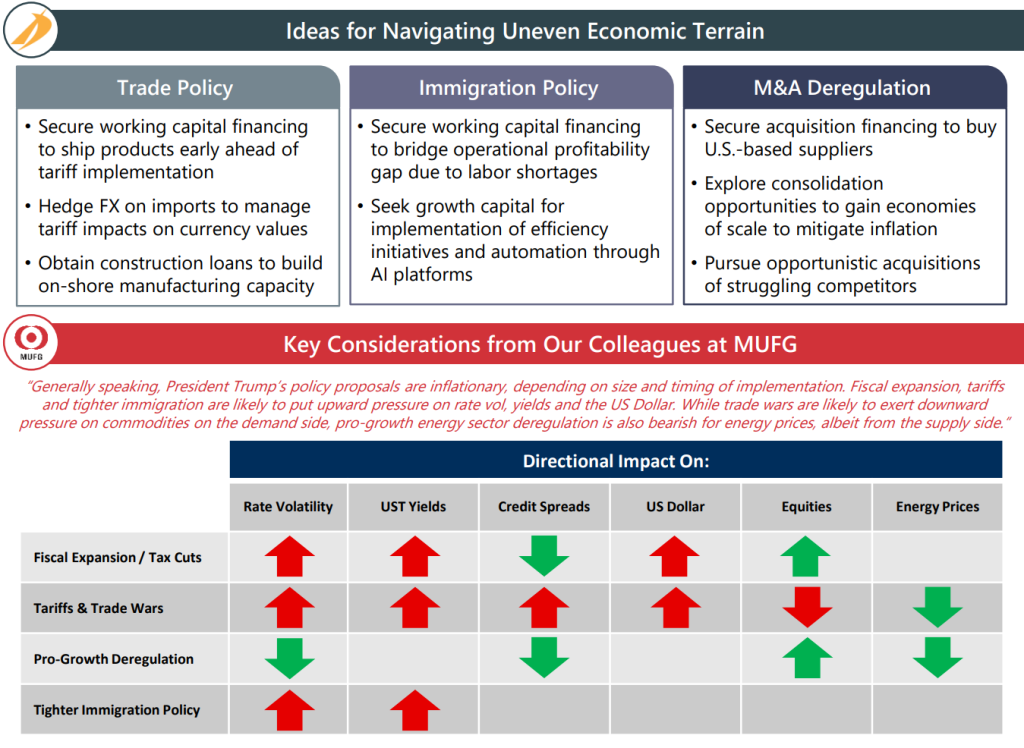

It’s Presidents’ Day Week! With executive orders flowing at a record pace, the new administration’s focus on trade, immigration, and deregulation will have a material impact on funding requirements for businesses large and small. Intrepid’s Capital Advisory team is here to help companies access capital in a complex geopolitical environment:

- Trade Policy – This administration’s broad-based tariff agenda is larger in scope, faster, and potentially longer in duration than previous trade wars. The “great reallocation” in global supply chains may involve a capital-intensive reaction to rising import costs and related on-shoring investments.

- Immigration Policy – Stricter immigration policies could limit access to workers at all skill levels, increasing labor costs, exacerbating workforce shortages and putting pressure on working capital.

- M&A – The new administration has signaled a commitment to easing regulatory constraints around M&A activity, thus creating a window of opportunity for strategic acquisitions and increased need for related financing.

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com