Going for Gold: The difference between standing on the podium and wiping out on the slopes rarely comes down to raw speed alone. Endurance, balance, and disciplined execution over a long course ultimately determine success. Private markets are competing in a similar endurance event – one where hold periods are stretching longer, forcing asset managers to find creative ways to return capital to limited partners (“LPs”).

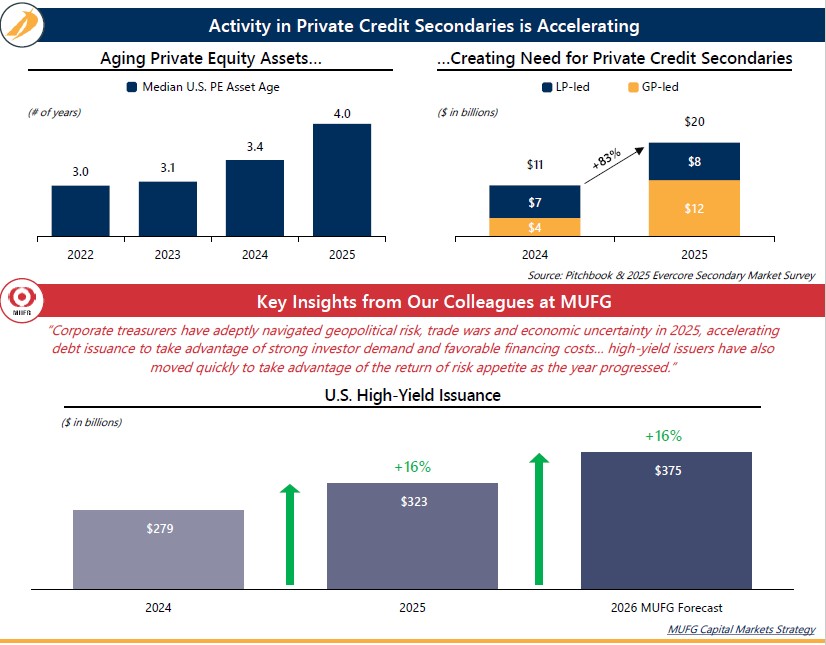

- Endurance in Private Equity: Longer hold periods demand patience and discipline, as sponsors prioritize staying upright over forcing exits that risk a late-stage wipeout.

- Flexibility in Private Credit: Driven by general partner (“GP”)-led continuation vehicles – a form of secondary transactions that provide LPs liquidity without forcing asset sales – a growing market is giving credit managers much needed breathing room to avoid catching an edge.

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@Intrepidib.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@Intrepidib.com

- Stephen Senior, Associate, Capital Advisory, ssenior@Intrepidib.com

- Anish Balabhadra, Analyst, Capital Advisory, abalabhadra@intrepidib.com

- Sam Nielsen, Analyst, Capital Advisory, snielsen@Intrepidib.com