The Open Championship! At Royal Portrush, success isn’t about overpowering the course – it’s about understanding the terrain, adjusting to the wind, and executing with discipline. Lower Middle Market borrowers in today’s private credit market must do the same: stay nimble, execute with clarity, and maintain operational excellence. Lenders are focused on quality and are willing to reward players who stand apart from the pack.

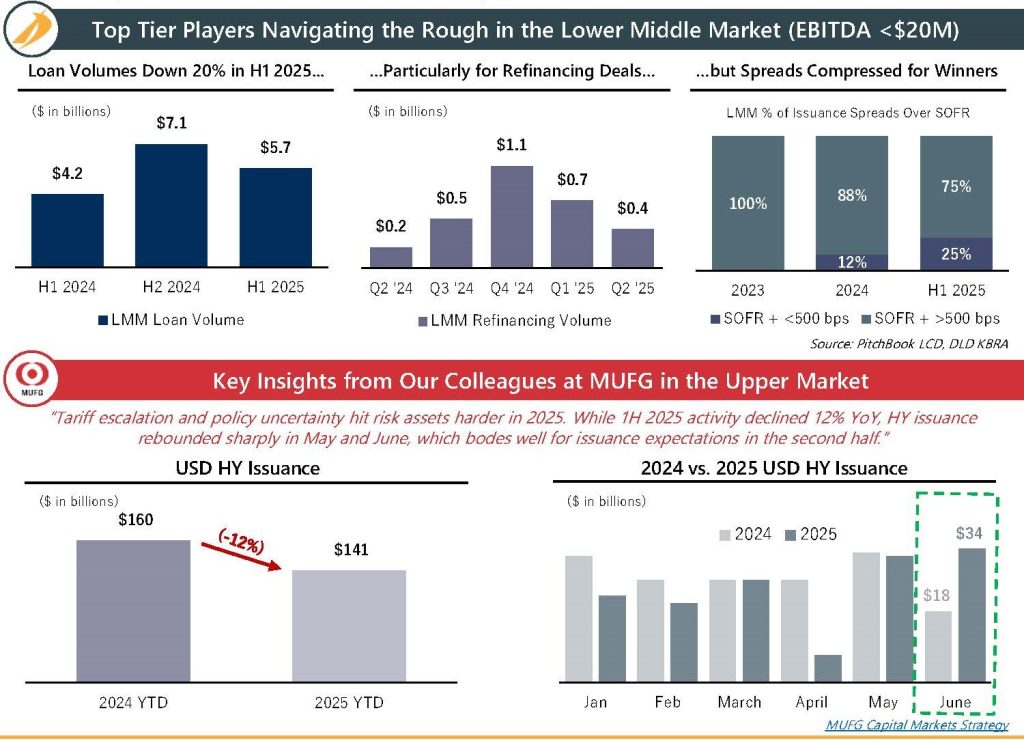

- Headwinds Picked Up in H1 2025 – Macroeconomic concerns about tariff implementation and fiscal policy direction continue to hinder proper golf club selection

- Damp Fairways Created Slippery Conditions – Refinancing activity has slowed, with many borrowers opting to wait for a dry spell when the macro picture is more favorable and predictable

- Opportunities for Birdies Remain – With many lenders under-deployed, competition for quality deals is fervent, allowing some borrowers to notch a lower financing costs on their scorecard

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com