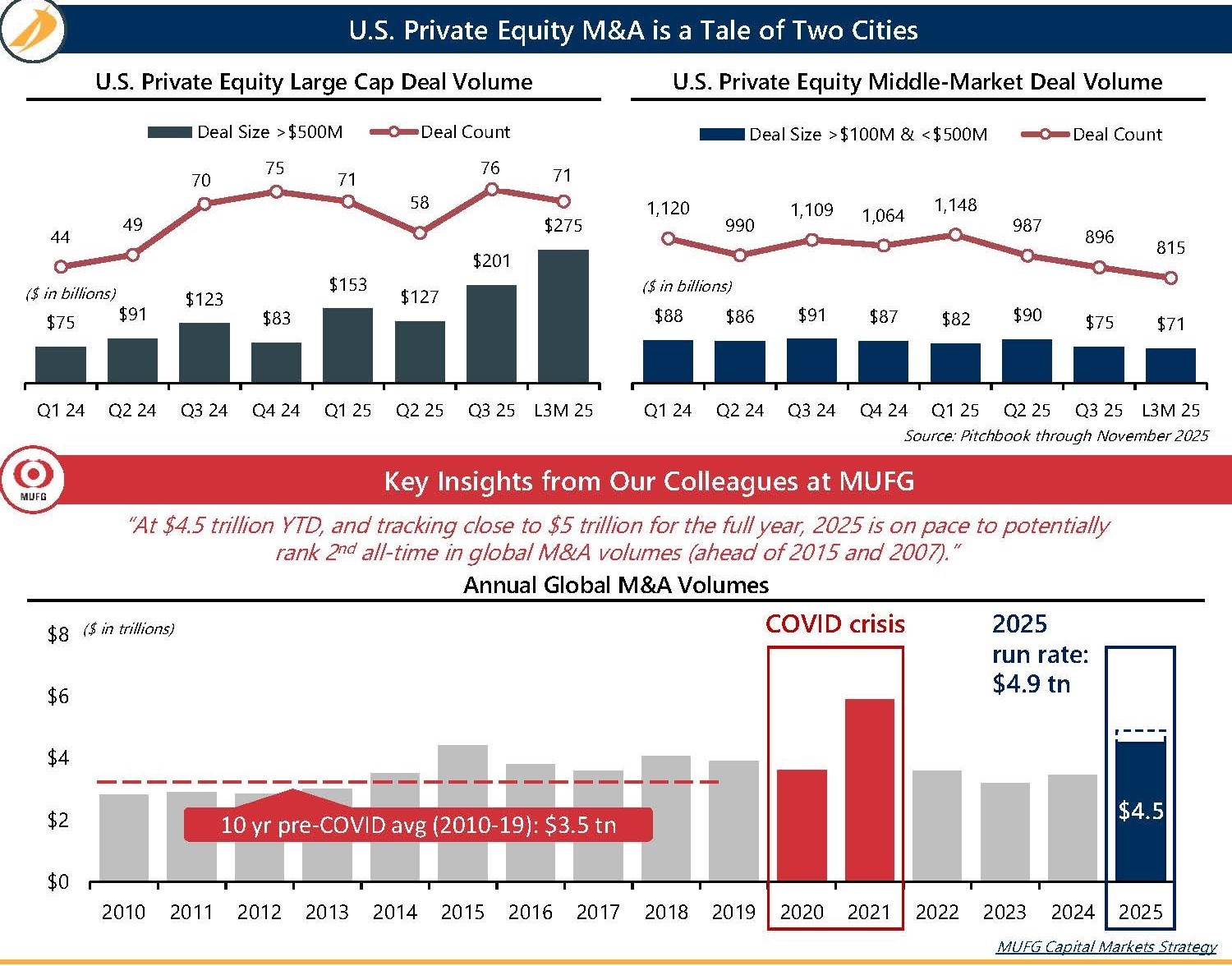

New Year, New Resolution: With the holidays upon us and New Year’s resolutions taking shape, the M&A landscape reveals sharp contrasts and growing complexities. While overall M&A volumes are up, the same cannot be said about the middle-market. As transaction timelines elongate, due diligence processes dig deeper, and capital providers become elusive, the best resolution may be more helping hands and advisory elves in the M&A workshop.

- Big, Shiny Ornaments: Strong performance across the large cap M&A market has been sustained by outsized transactions, yet deal count tells a more accurate (and less cheerful) story.

- Quiet, Snowy Night: Both deal volume and deal count have declined across the middle-market, driven by buyer caution and financing challenges – resulting in a muted pipeline-conversion environment.

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@Intrepidib.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@Intrepidib.com

- Stephen Senior, Associate, Capital Advisory, ssenior@Intrepidib.com

- Anish Balabhadra, Analyst, Capital Advisory, abalabhadra@intrepidib.com

- Sam Nielsen, Analyst, Capital Advisory, snielsen@Intrepidib.com