Remember during the outset of the pandemic when we all decided we were going to be professional chefs, dedicating hours of our days to make the perfect sourdough, banana bread, or decadent baked pasta? As restrictions ease and we spend less time at home, some of our most elaborate pandemic meals have become a thing of the past. However, home cooking in some shape or form is here to stay as 85% of Americans say that they will be cooking more at home in 2022(1).

At the height of the pandemic, Americans ate 88% of their meals at home, up from the 83% pre-pandemic level. Two years later, meals eaten at home have leveled off to about 85% of the total meals consumed, but the two percentage point increase from 2019 levels is equivalent to an estimated 2.9 billion meals and snacks per quarter(2). This increase in meals at home has a wide-ranging impact throughout the food and beverage industry and supply chain, from manufacturers to grocery retailers, and even durable consumer goods such as small appliances. Air fryers for example reached over $1 billion in sales in the U.S. in 2021, representing a 20% increase compared to 2020(2).

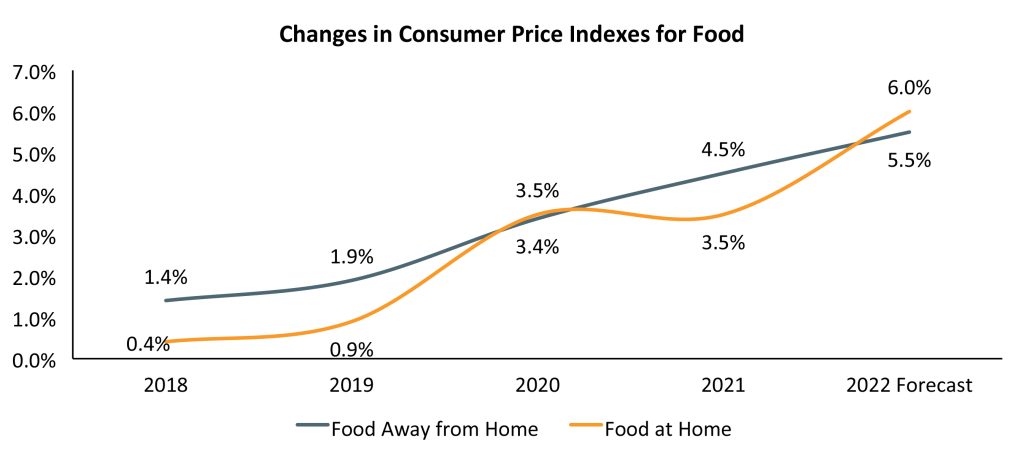

Source: U.S. Bureau of Labor Statistics Consumer Price Indexes (not seasonally adjusted) and forecasts by USDA, Economic Research Service.

As Americans continue to cook at home with less time on their hands, we anticipate rising demand for flavor and meal enhancer products such as ready-to-use rubs, marinades, sauces, dressings, and blended spices. Consumers can use these products to cook tasty meals at home while reducing preparation and cooking times. Moreover, utilizing flavor and meal enhancer ingredients is an easy way to replicate flavors that are hard to attain when cooking from scratch such as those from Mexican, Caribbean, African, and Asian cuisines. Seasonings and flavorings focused food companies such as Hispanic spice heavyweight Badia and Afro Latino newcomer A Dozen Cousins made splashes at their booths filled with an arsenal of existing and new products in the 2022 Natural Products Expo West Tradeshow in Anaheim.

M&A activity in the space remains strong with recent high-profile transactions including TA Associates’ acquisition of Stonewall Kitchen from the Audax Group; Olam International’s acquisition of Olde Thompson from Kainos Capital; Sauer’s’ acquisition of Mateo’s; and MidOcean Partners’ acquisition of Louisiana Fish Fry from Peak Rock Capital.

Another product segment that will likely face rising demand this year is prepped meal components that combine basic entrée ingredients while maintaining a home cooking aspect. For instance, consumers use meal kits or pre-seasoned and marinated protein products to spend less time in the kitchen while still feeling like they cooked. Great examples include Mighty Spark’s seasoned ground chicken packs and turkey/chicken patties (with flavor inclusions such as spinach and feta or queso and jalapeno), and Kevin’s Natural Foods’ sous vide cooked paleo/keto forward protein entrees (with flavors such as cilantro lime and tikka masala). Mighty Spark (advised by Intrepid Investment Bankers) and Kevin’s Natural Foods garnered strong interest from private and growth equity investors and completed transactions in 2021.

Both new and established food companies that offer the consumer exciting flavor enhancing products and prepped meal components that reduce time in the kitchen while maintaining some home cooking aspects are well-positioned to benefit from the billions of meals that will be consumed in American households in 2022 and beyond. Shifting eating patterns between food at and away from home will continue to be dynamic as new ways of living and working during the pandemic take hold as well as more recent fears of inflation and recession likely drive cost-conscious consumers further towards eating occasions at home. Investors are attracted to these favorable industry tailwinds and will continue to engage in M&A activity in the space.

(1) Foodinstitue.com.

(2) NPD Group.