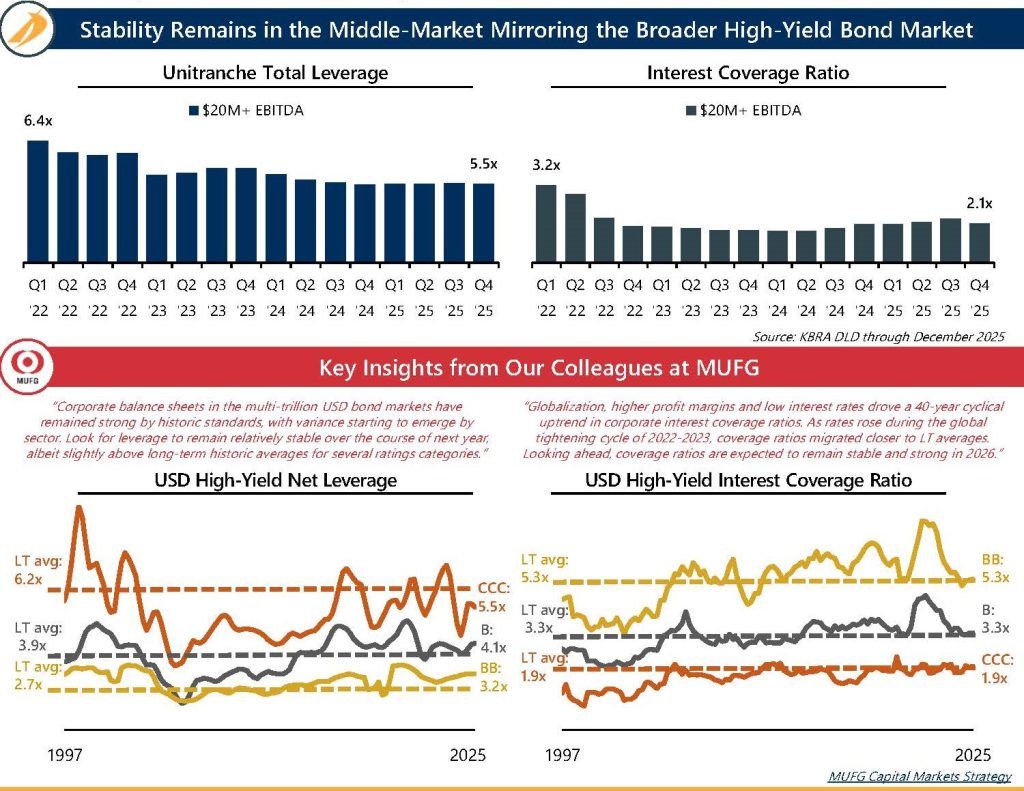

New Year, Same Credit Rigor: Just as leverage in high-yield bonds is expected to hover near long-term averages, middle-market borrowers continue to maintain relatively steady leverage profiles supported by disciplined underwriting, resilient cash flows, and lender selectivity that has become a structural feature in the space. After recalibrating through the 2022–2023 rate spike, coverage ratios in the middle-market have normalized toward long-run levels and are positioned to remain firm in 2026 as rate stability and healthy margins anchor performance.

- Leverage is Holding Steady: Starting 2026 with the same disciplined, middle-market balance that refuses to break its long-run resolutions

- Interest Coverage Staying Strong: Coverage ratios are sticking to their routine, keeping cushions firm and consistency front and center for another cycle

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@Intrepidib.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@Intrepidib.com

- Stephen Senior, Associate, Capital Advisory, ssenior@Intrepidib.com

- Anish Balabhadra, Analyst, Capital Advisory, abalabhadra@intrepidib.com

- Sam Nielsen, Analyst, Capital Advisory, snielsen@Intrepidib.com