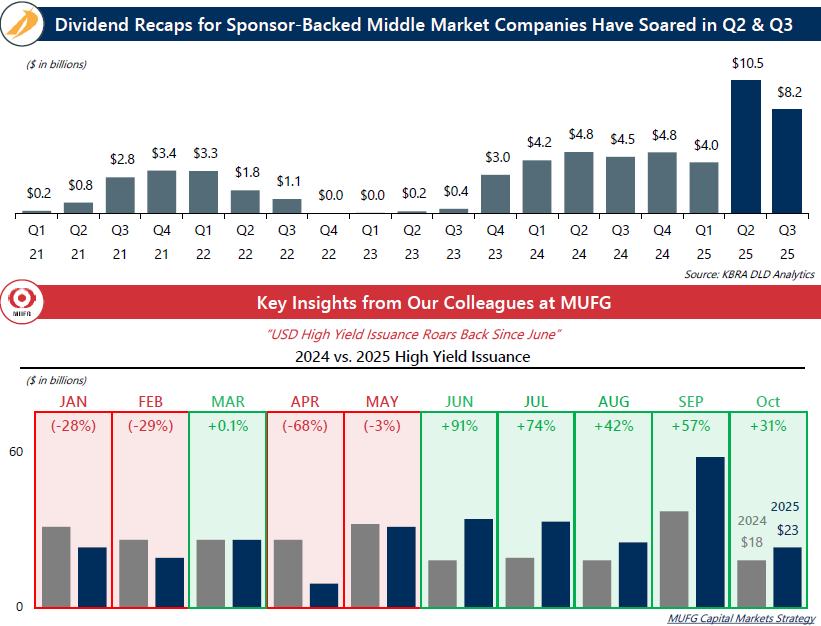

Gobble, Gobble, Gobble: This Thanksgiving, an abundance of dry powder in debt capital markets is providing middle-market private equity firms an opportunity for an exceptional holiday feast. A recent and welcome surge in the dividend recapitalization market is acting as an incremental boost to DPI metrics.

- Bountiful Harvest: After several quarters of high interest rates and stalled exits, lower borrowing costs and under-deployment across many credit funds are allowing private equity firms to carve out juicy dividends, while securing valuable credit partners to support their portfolio companies through a successful exit.

- Avoiding Heartburn: While LPs may be thankful for the liquidity banquet, too many helpings could leave some portfolio companies feeling stuffed; balance and moderation remain the wisest guests at this year’s table.

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@Intrepidib.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@Intrepidib.com

- Stephen Senior, Associate, Capital Advisory, ssenior@Intrepidib.com

- Anish Balabhadra, Analyst, Capital Advisory, abalabhadra@intrepidib.com

- Sam Nielsen, Analyst, Capital Advisory, snielsen@Intrepidib.com