Double, double toil and trouble… As the nights grow longer and temperatures drop, foreboding trends are appearing in private credit. Key indicators across portfolios of business development companies (BDCs) are beginning to spook investors, who are increasingly finding skeletons in the credit closets.

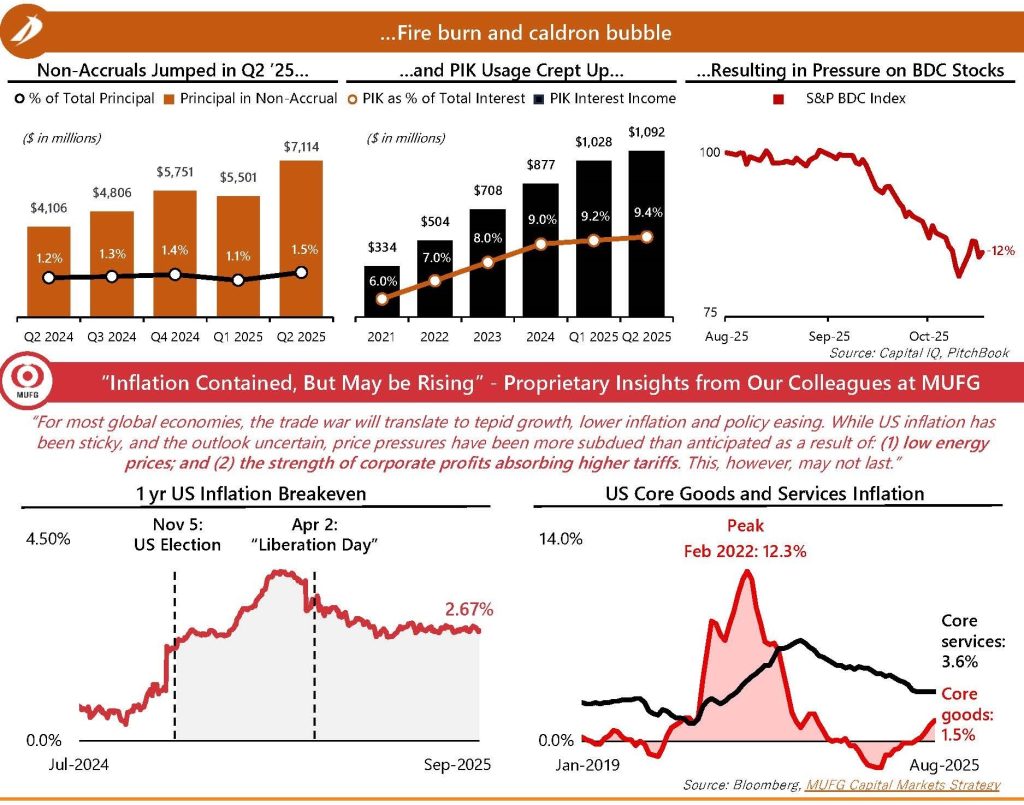

- The Undead are Stirring: Loan balances marked as non-accrual by BDCs surged by $1.6 billion in Q2 2025 (29% increase vs Q1). Such loans are now ~1.5% of the total amount lent by BDCs, higher than any period since Q1 2024.

- The PIKening: As a sign of frights to come, the usage of payment-in-kind (PIK) interest continues to creep up. In Q2 2025, 9.4% of interest earned by BDCs was in the form of non-cash payments. BDC equity holders are getting scared – as demonstrated by downward share price pressure since the beginning of August.

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@Intrepidib.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@Intrepidib.com

- Stephen Senior, Associate, Capital Advisory, ssenior@Intrepidib.com

- Anish Balabhadra, Analyst, Capital Advisory, abalabhadra@intrepidib.com

- Sam Nielsen, Analyst, Capital Advisory, snielsen@Intrepidib.com