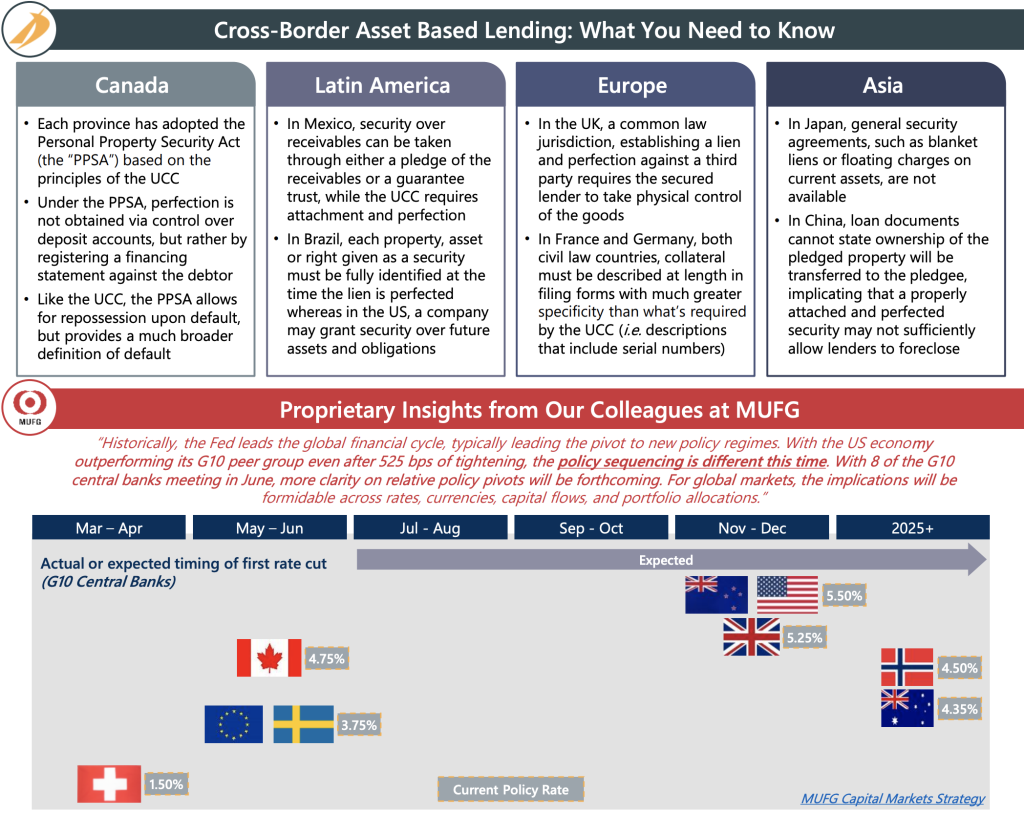

The Flattening World of Corporate Lending: Our clients have long been seeking to tap creative financing options that leverage their assets and cash flows domiciled outside the United States. Historically, this has meant multiple lenders with discrete collateral pools, complex repatriation agreements, and a drawn out closing process. With the globalization of private credit and cross-border consolidation among commercial banks, more efficient, one-stop solutions are gaining prevalence. Many feature asset based loans, which can increase borrowing power for companies with less predictable cash flows. While the US relies on the Uniform Commercial Code ("UCC") to standardize rules across state borders, each international jurisdiction has its own nuances around collateral treatment, lien perfection, and capital recovery that must be carefully considered – both by lenders and borrowers.

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com