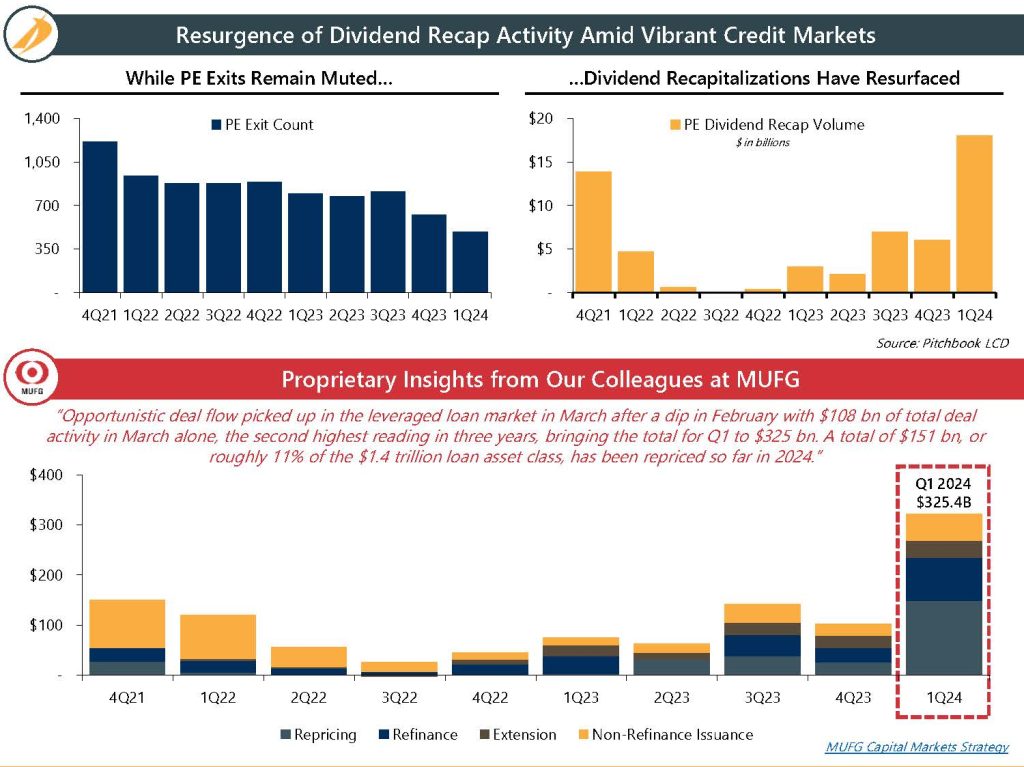

Happy Tax Day! Refunds from Uncle Sam are not the only way get money back this year. Shareholders take note – dividend recapitalizations are back in style. After over two years on the “no fly zone,” investment committees have started to open their checkbooks. That said, the bar is high.

- Notwithstanding elevated new deal activity, successful private equity exits in Q1 were limited. With no guarantee of a soft landing, sponsors are hedging their bets by exploring recapitalizations as a short-term solution to return capital to LPs.

- Lenders – many of whom were under-deployed in 2023 – are entertaining such discussions across sectors. To get to the finish line, the credit needs to be pristine and the sponsor must have an impeccable track record.

- Telling the right story is crucial for a successful outcome. We’re here to help.

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com