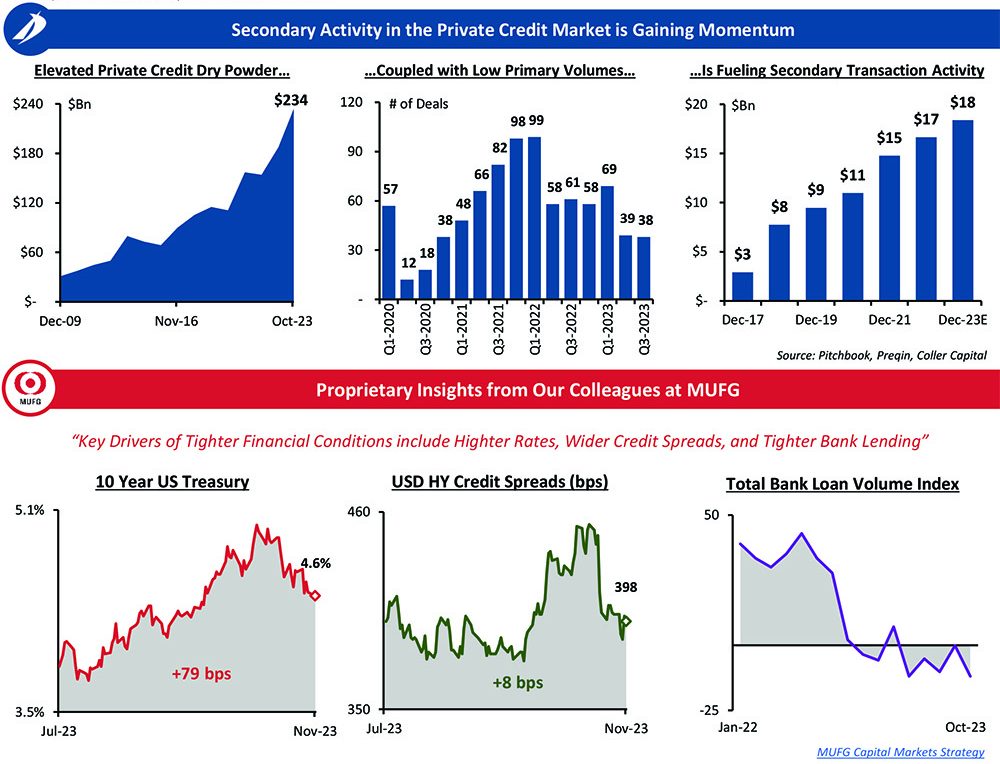

Attention Holiday Shoppers! ‘Tis the season to buy things at a discount and investors are no exception. Discerning buyers are compensating for a slowdown in primary deal flow by seeking valuable opportunities in the burgeoning private credit secondary market. Prospective borrowers and business owners should take note. Properly structuring loan documents can help prevent an undesirable counterparty from suddenly entering the capital stack.

- Assignment provisions: borrowers and their attorneys should pay attention to language in credit agreements - and ensure that any assignment requires prior written consent

- Right of first refusal: Consider negotiating a side agreement that allows the borrower to match any offers made by prospective loan purchasers

- Maintain constant dialog with competing lenders: an opportunistic loan refinancing by the borrower could short circuit a secondary sale process initiated by the incumbent lender

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com