Intrepid announced today that it acted as the exclusive financial advisor to Connetics USA (Connetics) on its sale to AMN Healthcare Services, Inc. (NYSE: AMN). Founded in San Diego, California… Read more »

Intrepid announced today that it acted as the exclusive financial advisor to Connetics USA (Connetics) on its sale to AMN Healthcare Services, Inc. (NYSE: AMN). Founded in San Diego, California… Read more »

Intrepid announced today that it served as financial advisor to Aptive Environmental, LLC (Aptive) on its recapitalization and growth financing with Owl Rock Capital Corporation (Owl Rock), a middle-market focused… Read more »

Remember during the outset of the pandemic when we all decided we were going to be professional chefs, dedicating hours of our days to make the perfect sourdough, banana bread,… Read more »

Many business owners are often approached on an unsolicited basis, by potential strategic or private equity buyers seeking to acquire their company. Here is a framework to help you think… Read more »

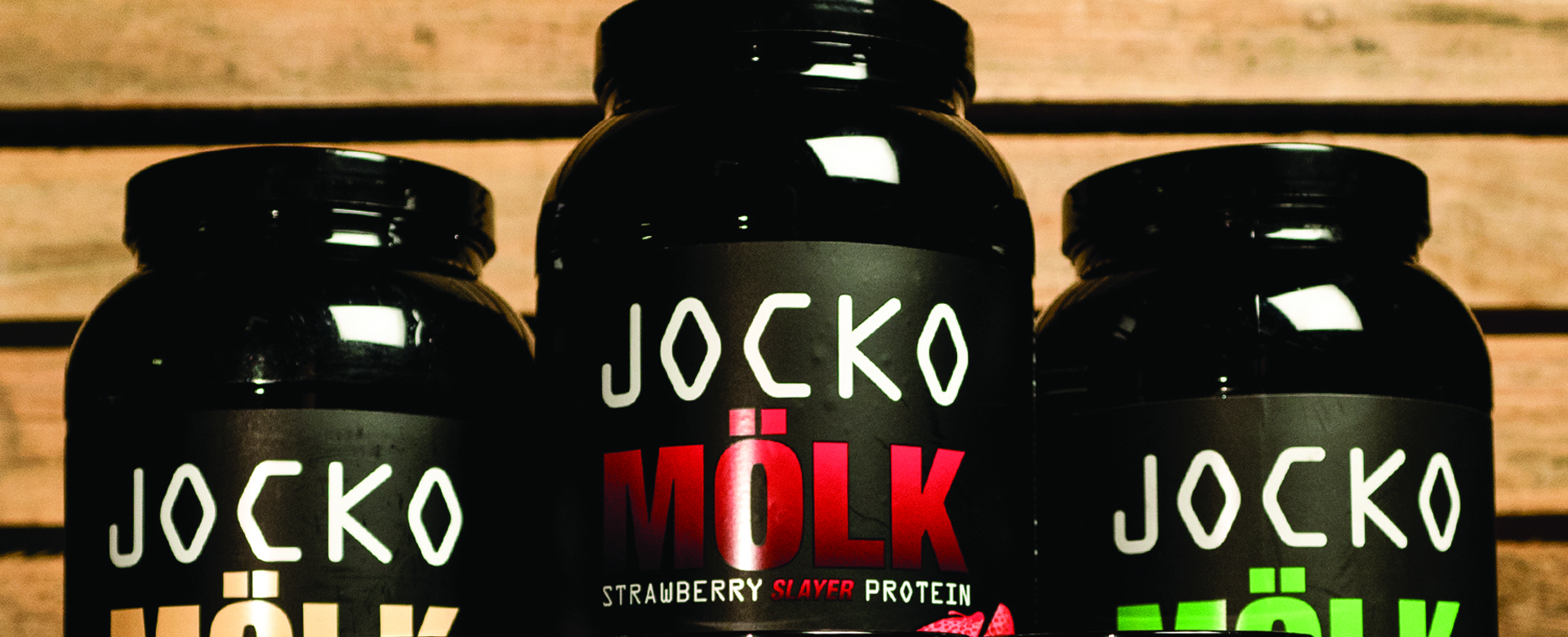

Intrepid announced that it acted as the exclusive financial advisor to JOCKO FUEL, a fast-growing provider of premium sports nutrition, dietary supplements, and consumable energy products, on its $30 million… Read more »

Three Intrepid bankers, Michael Garcia, Jonathan Zucker, and Adam Abramowitz were selected to be profiled among an elite group of 2022 visionaries in the Los Angeles Banking and Finance: Trends,… Read more »

Intrepid announced today that it has acted as the exclusive financial advisor to Bubbies Fine Foods (“Bubbies”), an established, market leading provider of pickles and other fermented food products, on… Read more »

Healthcare investors, whether they be private equity firms, public companies or non-profit institutions, are always on the lookout for underdeveloped subsectors that are well-positioned for disruption, consolidation, and growth. An… Read more »

M&A reached a record pace by the end of 2021 and has yet to show signs of slowing. A variety of factors drove heightened deal volume in 2021, including aggressive… Read more »