Let the Games Begin! The Olympics won’t be the only place to find healthy competition this summer, as risk appetite among credit investors continues to surge. Competitive tension remains strong between the private credit and bank markets, creating an opportune window for borrowers to raise capital at relatively attractive pricing.

Here’s what we saw in the first half (“H1”) of 2024:

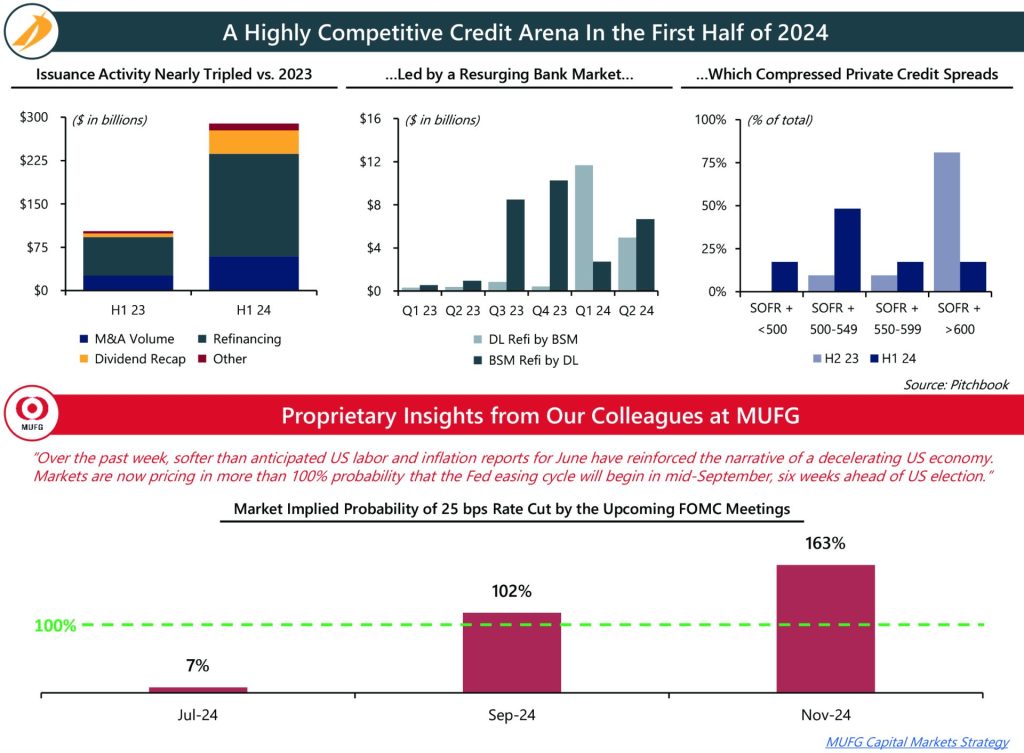

- Refinancings took the gold in H1 2024 by issuance volume; dividend recapitalizations and M&A-driven financings also saw a significant year-over-year improvement

- It was a tale of two quarters for large cap financings, where the broadly syndicated market (“BSM”) jumped to an early lead in Q1, followed by a heroic comeback by direct lenders (“DL”) in Q2 2024

- Such competition naturally resulted in a significant compression in credit spreads in the private credit market (generally 50-75 basis points, or .50% to .75%, since the end of last year)

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com