A Rosy Mother’s Day Outlook for Credit Markets! Middle market companies may find this an opportune window to take advantage of family-friendly spreads and nurturing lenders eager to deploy capital. With deal activity ramping up, we’re seeing more inquiries for refinancings and dividend recaps – both from borrowers in need of a solution and lenders seeking new credit exposure. This is in stark contrast to where we were 12 months ago.

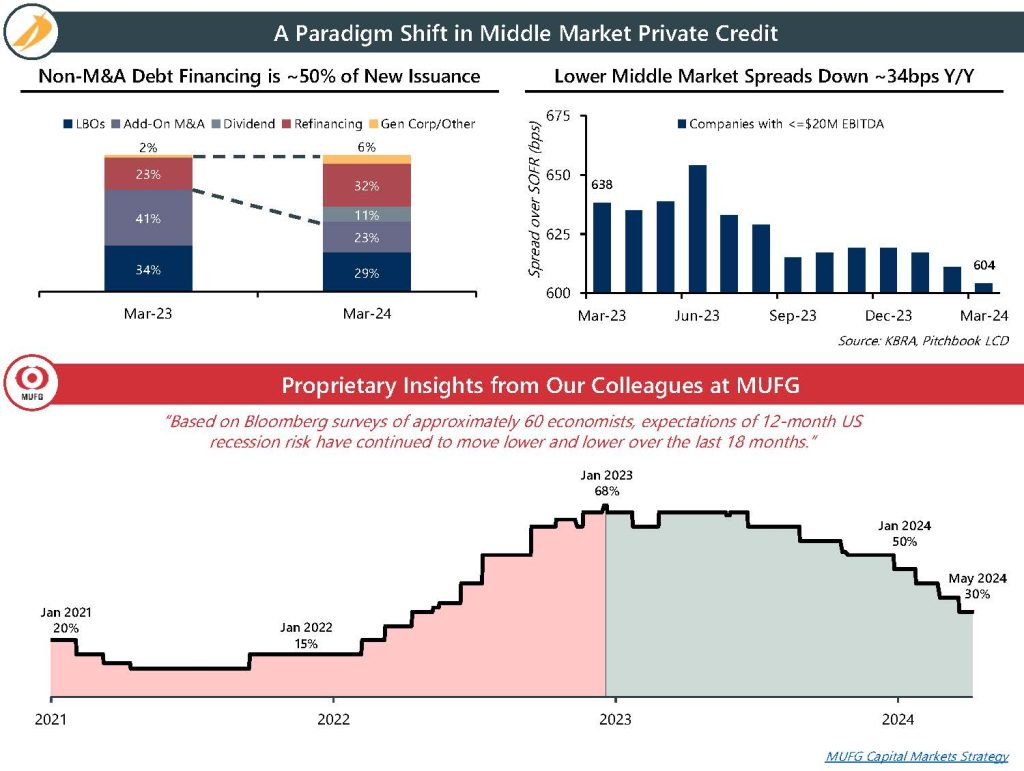

- Non-M&A debt deals now constitute roughly 50% of middle market private credit activity (vs ~25% a year ago)

- Refinancings are most common and dividend recaps are finally back en vogue

- Notwithstanding a higher-for-longer base rate environment, credit spreads continue to tighten, indicating investor optimism in the economy. For lower middle market issuers, typical direct lending spreads are nearing 600bps

Connect with Our Team

- Jonathan Zucker, Managing Director, Head of Capital Advisory, jzucker@IntrepidIB.com

- Boris Zikratov, Director, Capital Advisory, bzikratov@IntrepidIB.com

- Stephen Senior, Associate, Capital Advisory, ssenior@IntrepidIB.com