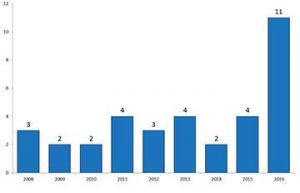

After several years of relative dormancy, the first half of 2016 saw a flurry of M&A activity with top audio/video (AV) systems integrators. Private equity (PE) investors continue to make big bets on the sector. AVI-SPL (H.I.G. Capital recently acquired the company), Diversified (Tailwind Capital provided an investment and supported the acquisition of Technical Innovation) and Verrex (Five Crowns Capital purchased a controlling stake from retiring family members) all partnered with new PE sponsors this year. What is driving interest in the sector and what does it mean for future activity? In reviewing the industry landscape, all these investors recognized the opportunity for growth and enhanced profits in the dynamic pro AV sector.

Opportunity for Transformation

With longstanding client relationships, these top integrators have earned the trust of demanding clients, which is difficult to displace. Much of the revenue is comprised of lower margin hardware sales. We anticipate there will be a substantial effort to improve margins and grow revenue via new services. Expect to see a push to offer a greater assortment of managed technology services that provide deeper connectivity with clients beyond typical “break-fix” contracts. These services might include content management for digital signage, video collaboration platforms, or cloud-based systems management. As the M&A market places a premium on this recurring, higher margin service revenue, such efforts will be critical to increasing valuations in the sector.

Follow the Client and Go Global

PE investors are attracted to the top integrators’ opportunities to expand alongside their top clients. Such growth with existing clients is lower risk and often can produce a better return on capital than investing to target new clients or market sectors. Following key clients into new geographic regions also substantially limits the cash burn associated with greenfield expansion and provides a solid foundation for growth. Under new PE ownership, we anticipate these integrators to increase the pace of new locations and international openings to support their top clients and provide entry into untapped geographies.

Platforms for Acquisitions

Don’t expect these PE investors to be satisfied with organic growth alone. As seen with Diversified’s acquisition of Technical Innovation, PE firms actively seek to “add-on” companies that complement their existing business. We think that many top integrators regularly receive such acquisition overtures and this may heat up. Consolidation activity is not confined only to PE-backed firms as evidenced by Avidex’s June 2016 acquisition of Digital Networks Group. We have found that acquirers often ask themselves these key questions when evaluating deals:

- Does the potential acquisition candidate offer strong relationships or presence in a particular segment such as healthcare, retail, corporate or government?

- Will the deal bring deep expertise in a particular product technology, such as video conferencing, digital signage, or command and control room?

- Can the acquisition help expansion in a particular geography?

- Coupled with these revenue prospects, will there be opportunities to drive efficiencies and increase profits through consolidation of back-office operations and purchasing savings?

When the Phone Rings…

What happens when your integration firm receives an inbound M&A inquiry? What should you do? What are the optimal next steps? What is your business worth? What happens if you do or don’t proceed with a deal? Our Commercial & Consumer Technology team is experienced to guide you through these important questions and help you avoid costly missteps.

We may very well be in the front end of a wave of consolidation activity for the sector. Grab your board, strap in, and enjoy the ride!